Since the Soil Carbon Coalition began in 2008 I've sampled soils and measured soil carbon and soil carbon change at hundreds of locations across North America. My basic question was, given that Life, and the circle of life, was the most powerful and creative planetary force, how do we humans work with it, as part of it? I knew that soil carbon was a critical factor for human health and survival. After some research and experiments I figured measuring soil carbon was a simpler task than measuring water in the soil, which was the #1 issue on the land almost everywhere--too dry, too wet, water too dirty.

Are carbon offset markets good or bad? We humans are committed and addicted to these kinds of good/bad judgments, and we apply them with shifting frequencies to wolves, knapweed, grazing, dietary fat, and of course people, including ourselves. We may not be able to avoid making these judgments but we can at least add a learning/evidence question: how do carbon markets or offsets function in different or larger systems or contexts?

Another popular judgment question: are we doing the right thing? We can also add a learning and evidence question here: what are the results we're getting?

First, a bit of background on the carbon cycle or circle of life.

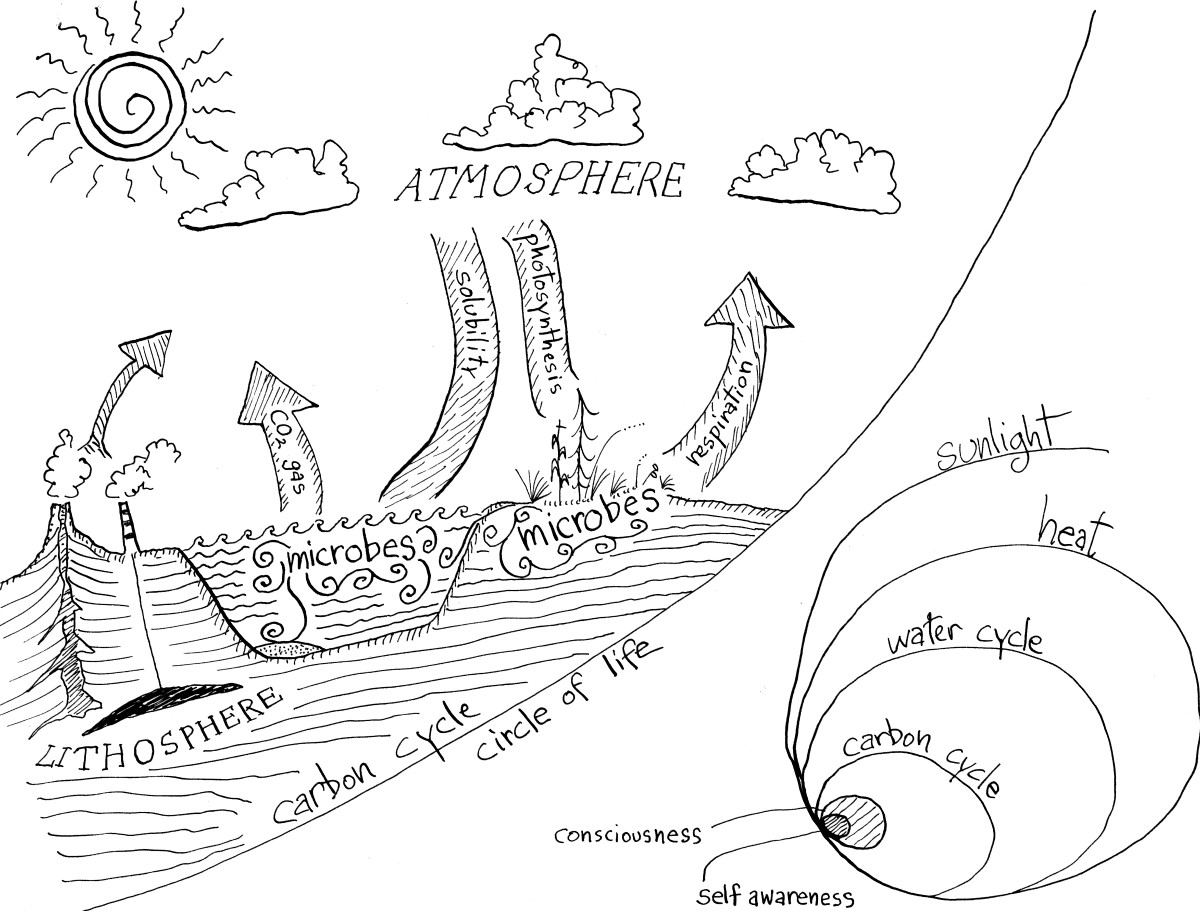

The complex carbon cycle, simplified. There are minor (but significant!) flows of carbon dioxide to the atmosphere on the left from volcanoes and fossil fuel burning. The major flows and loops involve 1) the land-based biological cycle, with photosynthesis drawing in carbon from the atmosphere and respiration/combustion delivering it back, and 2) the solubility of carbon dioxide in the ocean, and the release of this dissolved carbon dioxide back into the atmosphere according to Henry's Law and the Revelle Factor.

Both of these major flows are driven, and made complex, by the metabolisms and behaviors of photosynthesizers and microbes, which human actions influence. Any near-term "sequestration" or drawdown of atmospheric carbon dioxide into soils, trees, or rocks will be mostly compensated or buffered by the release of carbon dioxide from the oceans. Soil carbon and tree carbon have enormous benefits and use values for all forms of life including humans, but significant reduction of atmospheric carbon in our lifetimes is not one of them.

On the right, a bigger picture: the carbon cycle or circle of life is nested within larger flows of sunlight energy, such as the enormous work of water cycling. In soils, complex carbon compounds produced by all kingdoms of life filter water and moderate wet and dry conditions and the much greater power of the water cycle.

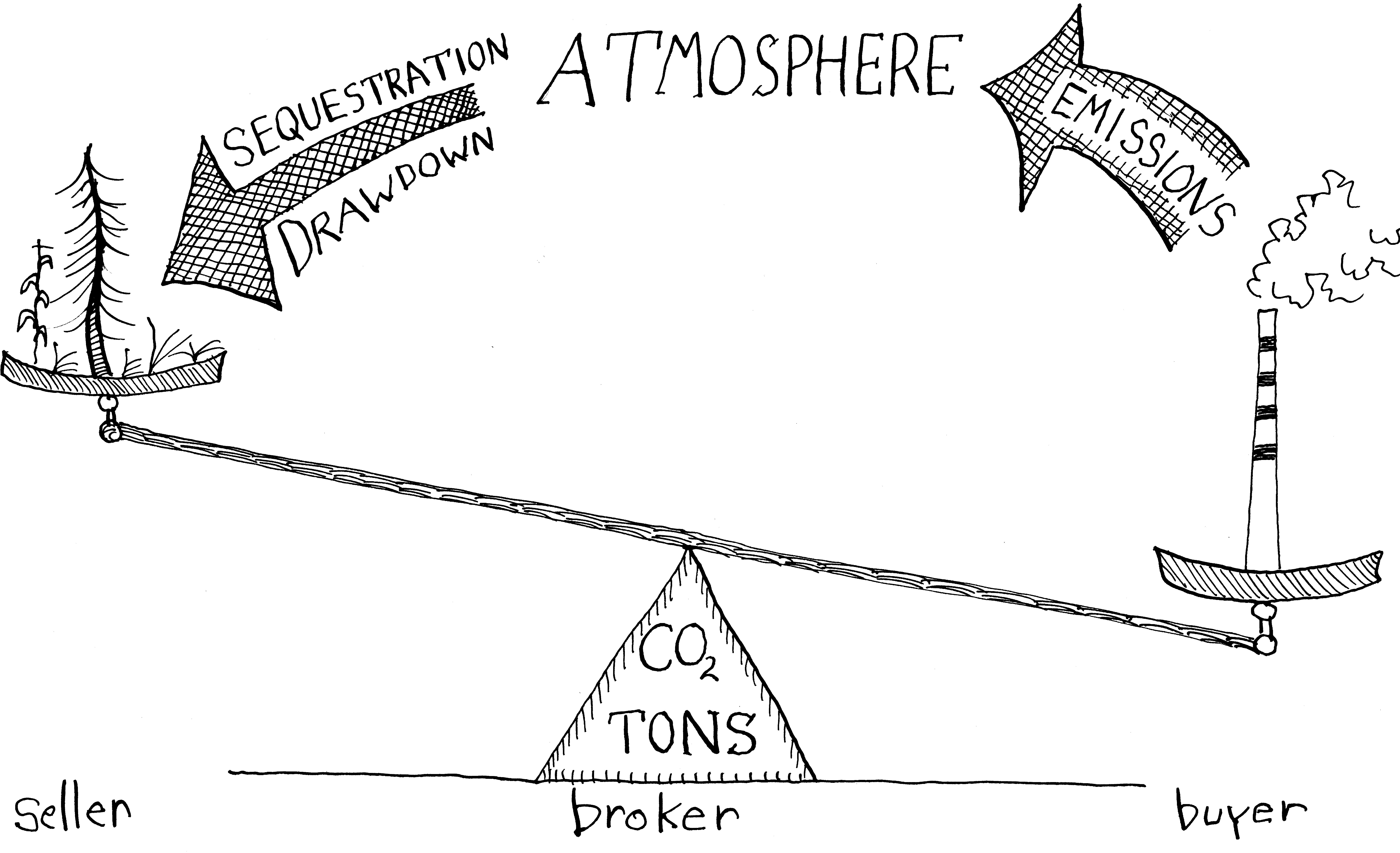

With the climate issue taking center stage, and the reluctance of governments to limit fossil fuel use, markets became a focus of attention. The following simplified model gave people an understanding of carbon cycling and climate as a problem, and made markets the self-evident way of offering a solution.

Here the mysterious and multiple complex relationships of the circle of life are reduced to a simple balance problem. From complex loops and relationships driven by metabolisms of plants and microbes and the solubility of CO2 in the oceans, the carbon cycle became a simple balance or stock-flow model with fossil fuel emissions on one side and sequestration, drawdown, or offsets on the other, with the balance measured or estimated in CO2 tons or equivalent. This simple balance allows us to pretend that we are in a simple system, can understand and manipulate cause and effect, and can address the problem with market mechanisms.

A broker is the architect and creator of the exchange. The broker arranges a trade between a seller (typically people who are managing lands or forests, and who want or need investment in their management) and a buyer (such as a company whose operations or supply chain causes carbon emissions to the atmosphere). In order for the simple balance model to approximate realities on the ground, carbon markets became as complicated as our tax codes, with jargon-encrusted controversies over quality, verification, additionality, permanence, loopholes, and leakage still proliferating, along with acknowledged weaknesses and some accusations of fraud. If you are trying to sell a partially imaginary exchange value, the packaging will become complicated.

How are carbon markets functioning, and what results are they producing? It's not black and white. Answers differ, often considerably, depending on people's perspective and situation. Do they help solve a problem that you have? What are the risks?

For a seller of carbon credits or offsets such as a land steward needing investment and wanting help with improving management or even implementing recommended or required practices, payments through carbon markets can be a good thing. If the seller accrues carbon, or is estimated to have done so by a computer model, he or she stands to benefit not only from the use values of biological carbon (such as moderating wet and dry, filtering water, enhancing production, lowering input costs), but also from a portion of its exchange or market value. The seller also faces risks: a) loss of management flexibility with required practices, b) costs of compliance with contracts, and c) price uncertainty. These risks vary by program or broker.

For a broker who creates a carbon market, the benefits include profit from matching sellers and buyers. The risks include serious mismatch between supply and demand, such as what collapsed the Chicago Climate Exchange in 2010.

For all parties to the transaction, the risks include shifts in the opinion of various publics: do people continue to believe that offsets are a good thing, thus rewarding companies who buy them? Do they believe offsets are valid, honest, effective? The risks also include the increasing cost of quality assurance, design, and packaging of carbon offsets.

From the larger, more complex perspectives of the carbon cycle or circle of life, and of the human capacity to manage it for broadly inclusive benefits, carbon markets and offsets are a shell game, shuffling tons of carbon dioxide equivalents from air to plants to land to sea and back again. It's been described as selling the wind, privatizing the air, sky money. We've falsified the complex carbon cycle into an abstract balance problem for which commodification and carbon trading become the self-evident recipe.

Where's the carbon? Air, land, or sea?

The shell game is a distraction, a scam, with no evidence or even prospect for near-term success in reducing atmospheric carbon. It helps perpetuate and even institutionalize a speculative bubble based only on the exchange value of an abstract ton of CO2 equivalent, which continues to vary according to the successes of its boosters, detractors, defenders, and critics. The balance model of the carbon cycle model along with carbon markets undermines the ability of individual land stewards and society as a whole to manage the complexity of earth's biosphere, the air, the circle of life.

The realization is growing that the importance of soil and forest carbon lies less in the presumed subtraction from atmospheric carbon, but in their effects on the water cycle, moderating wet and dry as Walter Jehne and others have explained, and filtering water. While these benefits to water cycling are increasingly being acknowledged as co-benefits to carbon trading, the trading itself is still dependent on sales of carbon "offsets," and we're still sideways with both climate and soil health in most places.

We live in a world that our questions create. The many alternatives that don't depend on sale of offsets or "payments for ecosystem services" are better long-term strategies for growing our capacity to invest in land stewardship and soil health. The CSP or EQIP programs of NRCS for example, or community options such as some land trusts or cooperatives.

Below, a recent panel discussion hosted by Northeast Organic Farming Association of New Hampshire and Seacoast Permaculture. The panel addresses issues with current carbon market programs and the challenges of trying to monetize something as elusive as carbon "sequestration" or best practices in farming. Includes insights about Vermont’s efforts to encourage a regenerative relationship with the land through other types of payments for ecosystem (PES) mechanisms.

Panelists include:

Amy Antonucci: Seacoast Permaculture

Cat Buxton: Grow More, Eat Less

Julie Davenson: NOFA-NH

Earl Hatley: LEAD Agency, Inc.

Caroline Gordon: Rural Vermont

Stephen Leslie: Cedar Mountain Farm and Cobb Hill Cheese

Finally, some links:

articles and resources on carbon markets at the Indigenous Environmental Network: https://www.ienearth.org/oppose-carbon-offset-scams-like-the-growing-climate-solutions-act/

John Bellamy Foster article: https://monthlyreview.org/2022/04/01/the-defense-of-nature-resisting-the-financializaton-of-the-earth/

Richard Norgaard's paper: Ecosystem services: From eye-opening metaphor to complexity blinder

Recent Posts

Archive

Categories

- Events (2)

- policy and framing (22)

- ruminations (3)

Tags

- atlas (2)

Authors

- Peter Donovan (136)

- Didi Pershouse (3)